Hiring a financial advisor can significantly impact your financial well-being. So, how do you go about choosing the best financial advisor for your needs?

View More

Toth's Takes

Toth's Takes

Hiring a Financial Professional

October 21, 2024New 529-to-Roth Rollover Option

October 4, 2024New 529-to-Roth Rollover Option

View More

New RMD Rules

October 4, 2024An overview of recent updates to the rules for Required Minimum Distributions

View More

Social Security Number Security

September 3, 2024We found out last week and sent a newsletter alert about the NPD data breach that exposed the Social Security Numbers of many Americans. Why is this important?

View More

Market Timing vs Time in the Market

July 24, 2024

"Don't try to buy at the bottom and sell at the top. It can't be done except by liars." — Bernard Baruch, investor and presidential adviser.

View More

Prime Day

July 12, 2024

In our last blog we talked about cybercrime This week we want to pass along an alert from the CEO of QR Code Generator about potential scams specifically around Amazon Prime Day.

View More

Cybercrime

June 26, 2024

Cybercrime, as defined by Britannica, is the use of a computer as an instrument to further illegal ends. Most cybercrime is an attack on information about individuals, corporations, or governments.

View More

Crypto Yes or No?

June 12, 2024

Does Crypto Deserve a Place in Your Portfolio? Is this an investment alternative worth looking further into? Where does it fit into a diversified portfolio?

View More

You’ve Received an Inheritance

May 21, 2024

You've Received an Inheritance, Now What? To follow up on our last discussion about the approaching transfer of wealth from Baby Boomers to Millennials and Gen Zers, here's the other side.

View More

Baby Boomers

May 8, 2024

We Baby Boomers currently hold 50% of all wealth in the United States. A huge transfer of wealth from Baby Boomers to Millennials and GenZers is expected to take place in the next 25 years. Estimates of the amount range from $50 trillion up to $93 trillion. Are you prepared?

View More

Inherited IRA Distributions

April 23, 2024The IRS recently announced that there would be no penalty for failing to take RMDs on certain inherited IRA accounts during 2024.

View More

It's Tax Season

February 22, 2024

It's tax season. If we didn't know it before, we know now by all of the commercials offering to help us spend our tax refund.

View More

What a Financial Professional Does for You

January 11, 2024

Last month we talked about the value of getting your financial advice from a Financial Professional. Yet, according to a 2022 report from Northwestern Mutual, only one third of Americans seek the help of a Financial Professional.

View More

Who is the most trusted source for financial advice?

December 15, 2023

Financial Professionals are the most trusted source of financial advice with advice from Financial Influencers (Finfluencers) coming in dead last.

View More

Season's Greetings and Some End of Year Tips

December 6, 2023

Season's Greetings! With the holiday season upon us and the end of the year approaching, we pause to give thanks for our blessings and for the people in our lives. It is also a time when charitable giving and tax planning often come to mind.

View More

Set It and Forget It? Maybe Not

November 15, 2023

A Target Date Fund (TDF) is a Mutual Fund that is structured to move a portfolio from higher risk and high growth in the early build-up years to more conservative choices at a specific date, generally the retirement date.

View More

Retirement ?

October 11, 2023

Retirement planning is about more than the income – it’s also about maintaining your standard of living.

View More

Trusted Contact

September 13, 2023

Do you need Trusted Contacts for your financial accounts? Yes! While it is not mandatory to list a trusted contact, it is highly recommended to do so.

View More

The Rules They Are A-Changin’

August 15, 2023

In the recent past, retirees were told to follow the 4% Rule for withdrawals from retirement accounts. More recent retirees face a whole different environment.

View More

Artificial intelligence

June 28, 2023

As I was reading last month’s Hot Topic Newsletter on our website, I got to wondering how life as we know it will be affected by Artificial Intelligence (AI).

View More

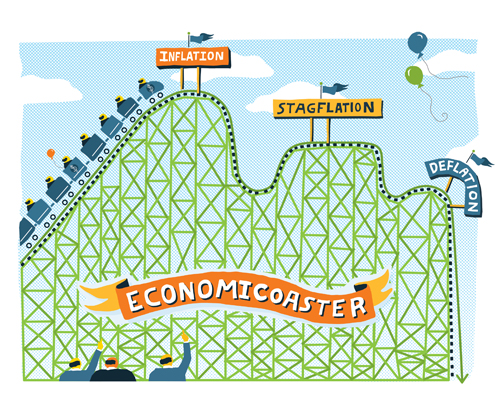

Investing in a Stagflationary Economy

June 7, 2023

What is Stagflation? Are we in a period of stagflation right now?

View More

More on Social Security

May 17, 2023

Estimating your future Social Security benefits used to be a difficult task, but not any longer.

View More

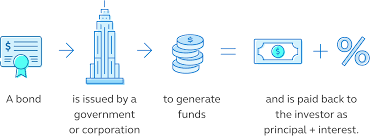

BONDS 101

May 9, 2023

What is a Bond? A bond is an IOU between the lender and the borrower. The issuer of the bond is the borrower and the lender is the person who purchases the bond the investor.

View More

Nat'l Consumer Protection Week

March 1, 2023

Back in October we talked about protecting yourself online - Now I'd like to take the opportunity to inform you about National Consumer Protection Week (NCPW). This event is sponsored by the Federal Trade Commission (FTC). During the week from March 5 through March 11 the FTC, in partnership with AARP and many government agencies, will provide information to help people understand their rights as consumers and avoid fraud.

View More

Social Security Facts & Figures

February 13, 2023

I hope you learned something new from our last blog about taxes. Now I will outline some dates and rates about Social Security.

View More

Tax Facts, Figures & Important Dates

February 13, 2023

At this date in February, we are all busily assembling our tax documents. I thought this would be a good time to review some important tax

View More

So, the IRS contacted you ...

January 11, 2023The IRS never uses social media or text messages to reach out to taxpayers. The IRS will NEVER call you until they have sent a letter or notice to your home or business.

View More

Lessons From the Christmas Cactus

January 3, 2023

The Christmas Cactus is one of my favorite plants. I have had one for close to forty years. The best thing about this little plant is that it blooms – near the end of December - when all the other plants are hibernating.

View More

What is Investing?

December 21, 2022

What is Investing? Investing is using your money to potentially create more money over a period of time.

View More

Relationships & Money

December 7, 2022

You have a relationship with money in the same way that you have a relationship with your partner. These relationships cannot help but impact each other.

View More

Thanksgiving is More Than Just a Day

November 14, 2022Thanksgiving isn't just a day. It's a way we can live our lives every day.

View More

It's Going to Cost More to Heat Our Homes This Winter

November 1, 2022

For many homeowners, heating the house in the winter is the second highest cost of ownership. And it's going to cost a lot more to heat our houses this winter.

View More

Social Security Cost of Living Adjustment - COLA

October 19, 2022The new COLA, 8.7%, is big — the biggest since 1981, when the adjustment was 11.2%. These automatic, yearly inflation increases began in 1975, during a decade of high inflation. Before then, it took action from Congress to raise benefit levels.

View More

Online Security Tips

October 3, 2022

Protecting Yourself Online. Everybody has probably heard of phishing, but not everyone may know just how it works and how to protect oneself from it. What is phishing?

View More

When is the Next Recession?

September 26, 2022When is the Next Recession? Wouldn't it be great to know when the next recession is coming, how long it will last and how to best position yourself to ride it out?

View More

About Recession

September 13, 2022

There has been a lot of dire talk lately about a recession. Negative economic growth this year seems to confirm the most pessimistic predictions. Definitions vary, but most economists agree that a recession is simply a prolonged and significant downturn in economic activity.

View More

Inflation and Your Retirement

August 23, 2022

"This year has been unnerving for retirees because it has been a triple whammy; falling stock prices, falling bond prices and high inflation", said Christine Benz, director of personal finance and retirement planning at Morningstar.It's a fact that high inflation hits hardest for people on fixed incomes; especially retirees. How are retirees feeling these days?

View More

Why is the Market Going Down?

May 2, 2022

Why is the market dropping from its peak at the start of the year when the economy, job growth and consumer spending seem to be managing? A healthy economy doesn’t always imply a strong stock market.

View More

IRS - Ineffectually Responding Service

February 22, 2022

Seems like we are headed for another troubling tax season. The IRS is still playing catch-up. There are backlogs in processing returns and refunds, and even tax notices.

View More

Recognizing Social Security SCAMS

January 3, 2022

The Social Security Administration will never threaten, scare, or pressure you to take an immediate action.

View More

Why ETHICS Matter

October 19, 2021

When a financial advisor becomes a Certified Financial Planner™ they must abide by the CFP Board’s Code of Ethics and Standards of Conduct.

View More

CFP - Who, What & Why?

August 23, 2021

To be certified as a financial planner professional there are educational and experience requirements. The person must also possess, and be committed to, high professional and ethical standards.

View More

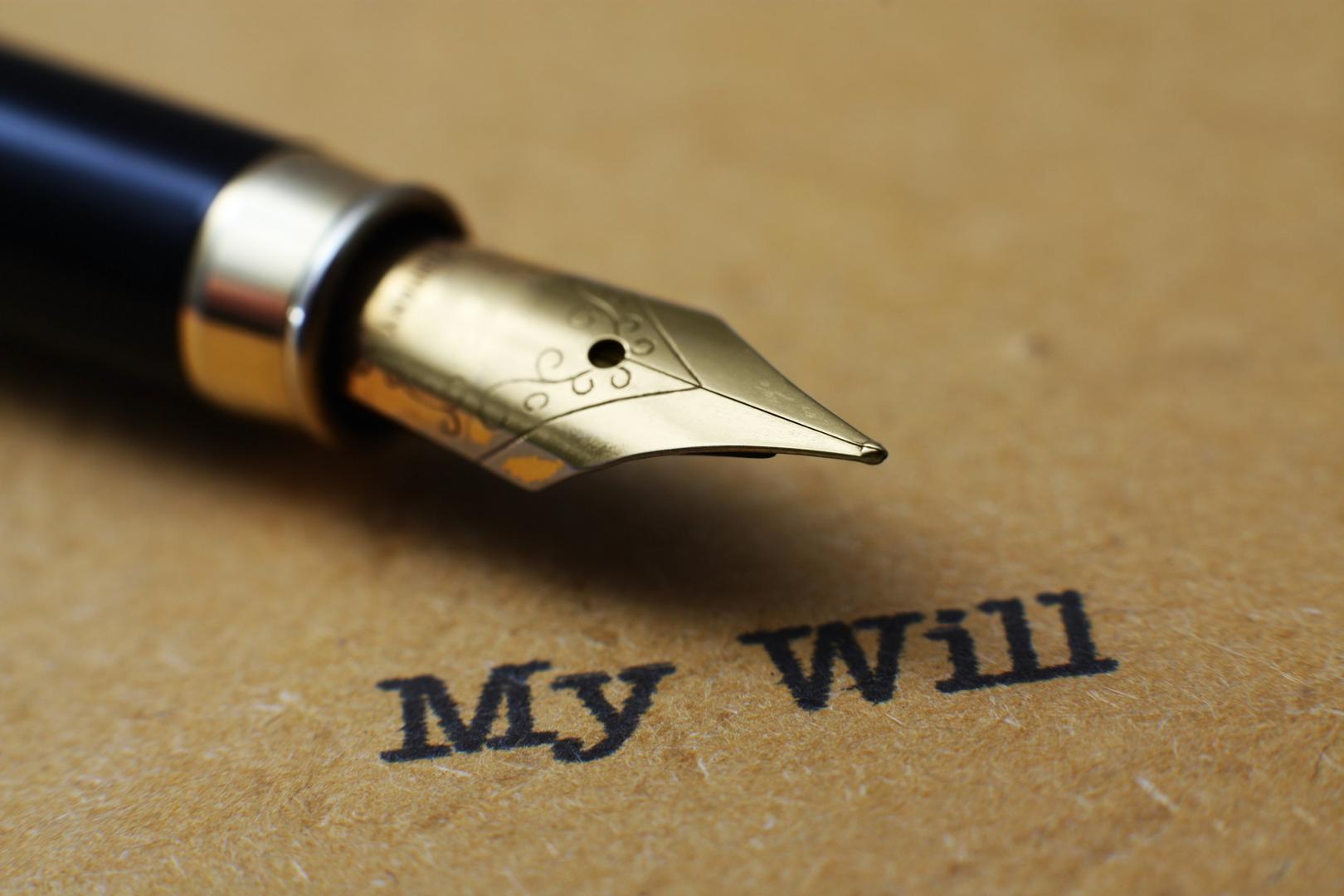

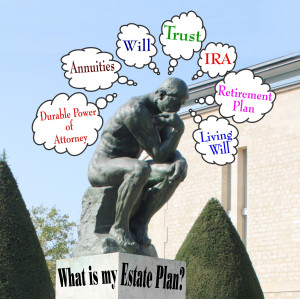

Will or Will Not?

June 1, 2021~001.jpg)

I am often approached by clients who have been left with the responsibility of settling an estate. It isn’t a walk in the park; with all the paperwork, details, emotions, family/friends’ relationships involved. A lightbulb goes off in their brains, realizing all the financial intricacies associated with money handling. They come to realize a professional may have a better grip on maneuvering in this melee than they do.

View More

Looking Back, Moving Forward

February 1, 2021

2020 will be remembered as a unique year to say the least. Many lessons were learned and some of those lessons will change our future. Some businesses suffered, even closed; some new areas of business were created and/or flourished. Some of us suddenly working from home will continue working from home. Maybe, most importantly, the pandemic proved to us which of our relationships are essential and some which are … not so much.

View More

2020 & You

December 15, 2020

How are you surviving 2020? Are you in a position to be benevolent or are you just barely hanging on month by month? Were you able to weather the “Covid storm”, maybe able to retire before it hit or did you just undertake a new venture in the midst of the turbulence? So many different scenarios have been created by this unexpected pandemic.

View More

How To Surf the Second Wave

November 18, 2020

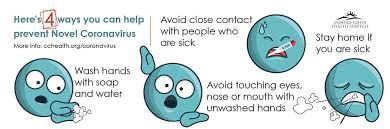

We were warned. It wasn’t a political ploy. It looks like the second wave of coronavirus is here and the numbers are higher than the first outbreak earlier in the year. Many travel restrictions are in place and quarantines are in effect. It is recommended to stay the course; frequent hand washing, mask wearing and limiting your time in public, with the 6 foot distancing rule.

View More

Retirement: REAL or RUSE

November 11, 2020

Being bombarded by free advice on retirement; on the internet, on tv, on the radio? There are plenty of suggestions telling you what you need to do; get life insurance, pay off your mortgage, you need X amount of money to retire comfortably. So you educate yourself, do the research; calculate what would work best in your situation.

View More

IRA: Traditional vs Roth

October 14, 2020

If you have been contemplating converting your IRA to a Roth IRA, here are some things to consider.

View More

Social Security NOW

September 1, 2020

For some of you Social Security isn’t even on your radar, for others it’s around the corner. Some may believe there may be no funds left by the time they reach the age to collect, other are counting on it to help them retire, if not comfortably, at least reasonably. Regardless of your age, there are a few things you should be doing right now with your Social Security account to insure the future.

View More

Potential Pandemic Silver Linings

August 3, 2020

A crisis can leave us better or worse. As most of us long for things to return to the way they were before COVID-19, observers from various fields believe our lives may actually improve in some areas after the virus is controlled.

View More

New at the Social Security Agency

July 27, 2020

If you are applying for benefits or receiving benefits from Social Security, you can now choose up to three advance designate representative payees.

View More

COVID-19 & Your Social Security ... Insecure?

July 13, 2020

The numbers are staggering. Social Security has been a cornerstone of retirement planning since its inception. I get it now that I am seventy and most of you do too or hope to receive that monthly Social Security check.

View More

FAANG?

July 6, 2020

Have you heard the term FAANG mentioned in the financial news? Do you know what was being referenced? FAANG is an acronym for five American technology stocks that are among the largest, best-performing companies in the world. As of January 2020, these five companies had a market capitalization of over $4.1 trillion. Are they in a bubble or are they well managed? They trade on NASDAQ and are included in the S & P 500.

View More

What Do Women Want?

June 18, 2020

A group of men and women +50 were polled on what was important to them concerning their hiring and working with a financial advisor or firm. You might be surprised to know that the women had more requests than the men. What did the women want?

View More

Disinfecting During the Quarantine

June 10, 2020

How many hours have you spent at home sheltering in place because of the global coronavirus pandemic? It’s not very exciting to sit around inside, but all this social distancing does open up a convenient opportunity to review your finances and make sure they’re “quarantine clean.” It is also an excellent time to review your insurance policies, like life and homeowners’ coverage. These products are often overlooked during an annual investment review but if you need them, you will be glad you did.

View More

Spring Clean Your Finances

June 3, 2020

What are some of your favorite spring-cleaning rituals? With so much time at home due to the global coronavirus pandemic, houses may be cleaner than ever this year. But don’t stop at sweeping up the house! Cleaning up recurring payments can bring even more simplicity and savings to your life.

View More

CARES Impact on Workers

May 28, 2020

Hey, hello again, everyone. Just trying to keep you updated on the #status quo. Now, as you probably know, Congress just passed the largest #stimulus package in American history, the Coronavirus Aid, Relief, and Economic Security Act (#CARES). This was done in an effort to combat some of the pandemic’s harmful economic effects.

View More

Is your ZOOM call secure?

May 12, 2020

As many Americans try to navigate this new normal of social distancing, we find ourselves on a lot of Zoom conference call invites. It’s helping to keep people in touch and maintain business during this global pandemic. There are a handful of security steps everyone should be taking to protect their privacy during calls, especially if the calls are professional in nature. There is an increase in Zoom-bombing, which is when unauthorized people hack into your meeting and puts privacy at risk.

View More

Seeing the Light at the End of the COVID-19 Tunnel

May 8, 2020

Any unpredictable situation in life is likely to bring emotional challenges and during these times of the #COVID-19 #pandemic, there’s definitely no shortage of them.

View More

Are Your Affairs in Order?

April 13, 2020

We have no way to expect the unexpected. And our current COVID-19/coronavirus, social distancing, self-quarantine-ing, is certainly unexpected. It never seems like the right time to discuss the future in terms of a will. However, not having a will can lead to all kinds of unnecessary battles your family might have to undertake in an already egregious situation.

View More

Pros & Cons: Wills vs. Trusts

February 14, 2020

Have you wondered which might be more appropriate for you; a Will or a Revocable Living Trust? Here are some of the advantages and disadvantages of each.

View More

SECURE or Setting Every Community Up for Retirement Enhancement

February 7, 2020

The SECURE Act legislation expands savings opportunities for workers and includes new requirements and incentives for employers that provide retirement benefits.

View More

10 Most Common Filing Mistakes

January 16, 2020

The TEN most common mistakes made on Income Tax forms and how to avoid them. The Affordable Care Act addressed. How to get your refund

View More

Happy New Year, It's Income Tax Time!

January 10, 2020.jpg)

Now that the holidays bills are coming due, you are probably also starting to receive those dreaded income tax applications, along with your tax statements for 2019. Some of these statements are required to be sent by the end of January, others not until mid or the end of February.

View More

Diversification or Di-worse-ification?

December 11, 2019.jpg)

In 2008 – 09 diversification did not work at all. What would’ve worked was asset allocation. Beebower & Brison stated that asset allocation determined portfolio return variation 94% of the time. Second, notice that they said nothing about diversification. How does diversification fit into the process of investing?

View More

ANNUITIES - MYTH #3, 4, 5 & 6

December 3, 2019

Market volatility is a real concern and as retirement age approaches your investments could be at risk to a market downturn just when you need them to be more consistent. The right annuity may be able to bridge the gap.

View More

Annuity: MYTH #2

November 8, 2019

Misconception #2 – Annuities are expensive. Fact: MANY ANNUITIES ARE LOW COST. While there will be some cost involved, as with most investment products, annuities offer more options and flexibility than some past annuity products with expenses and higher annual fees. Fees are based on features and benefits chosen and explained.

View More

Annuities: YES or NO

October 30, 2019

Ever thought about investing in an annuity? If you like the prospect of income with protection against market loss and the possibility of out-living your money, an annuity might be just the vehicle for your investments.

View More

Reitrement, In a Perfect World ...

October 11, 2019

Preparing for retirement is not a sport. LOL It requires dedication, discipline, endurance, and luck. But there’s a crucial difference … When you cross the finish line in a marathon, you know the race is over. But when you quit the workforce, it’s much harder to figure out whether you’ve successfully reached retirement finish line.

View More

Report on Social Security

October 2, 2019

Reports are that more than half of the population stresses on whether or not the Social Security System will be healthy enough to sustain them when they reach retirement age. Is this a realistic fear?

View More

ETF or ETN?

September 13, 2019

In this blog, I will attempt to explain a similar but different form of investment called an “Exchange-Traded Note” or ENT as compared to an "Exchange-Traded Fund" or ETF.

View More

POA & SSA

August 23, 2019

One issue that troubles me as my clients’ age, is who will handle their affairs/finances if they become incapacitated? This is keenly felt if you are single or have no children. Who is that trusted person? We don’t like to think about our own mortality, but the issues must be dealt with sooner rather than later.

View More

SYMPTOMS OF DEMENTIA

August 7, 2019

Noticing symptoms of dementia in its early stages can help prevent elder fraud, abuse or exploitation. I do have a good amount of clients who have been with me for a number of years who are now in the latter stages of life. It does concern me that they have family members and associates that may use their advanced age and limited capabilities to exploit them or if they are entirely alone.

View More

Choosing the Right Financial Advisor for You

August 1, 2019

So you’ve decided you’d like to work with a financial planner. The next step is to locate a few in your area. On our web site www.regardingyourmoney.com there is a banner located at the very top of the page “Check the background of this financial professional on FINRA's BrokerCheck”, when you click on either of the hyperlinks you will be transferred to a site with background information on me and other local advisors.

View More

Top 10 Reasons to Use a CFP™

July 25, 2019

At Chestnut Investment Advisory we offer essential support with hand-crafted strategies. I facilitate and ease my client’s relationship with their money. I look forward to working with you. George #CFP #CIMC #AIF #financialplanner #advisor #finance #investments

View More

The “Sandwich Generation”

July 18, 2019

The Sandwich Generation is defined as a demographic of the population that are caretakers for elderly parents while still supporting their own children. This creates an emotional and financial struggle in many situations. In some instances, more funds are being spent on elder care than child-rearing.

View More

Freedom Isn't Free

July 3, 2019

What a unique, brazen, foolhardy idea; that a group of people could comprise their own nation without a king or queen under a democratic rule. The experiment worked. Not smoothly, not without some bumps along the way, but still with the same goal of life, liberty and the pursuit of happiness – our unalienable rights.

View More

Niches & Crannies

June 28, 2019

A touted way of marketing in today’s business world is to cater to a specific niche. I have been exploring how I can apply this to my financial advising business. But I don’t want to limit myself or my potential clients.

View More

How Does ESG & SRI Affect YOU?

June 24, 2019

Two acronyms, ESG & SRI, might not mean that much for many investors but for some investors – Hey, Millennials!! – it might mean a world of difference in the equities they choose. Do you “eat clean” or adhere to a vegan lifestyle? Maybe you’re a “gym rat”, practice yoga or run marathons? Have a cause; Cancer research, smoke-free, support lightening the marijuana laws, part of the LGBTQ community, believe in palliative care, ... The list could go on, and on

View More

Crash-Proof Retirement, Really?

June 13, 2019

I’m sure you’ve all heard the ads espousing “Crash-Proof Retirement”. I know I’m getting tired of hearing them. Are you interested? Do you believe in the concept? I will try to give you a brief idea of what type of investment is being promoted by these advertising spots.

View More

His, Hers, Theirs

May 30, 2019

They are an elderly couple, each earned a high salary prior to retirement. Both felt it was important to invest a healthy portion of their salaries. There is just one small problem now; one of them is strongly risk-averse, preferring conservative investments such as certificates of deposit and money market funds, while the other one is a risk taker who still loves tech and biotech stocks and initial public offerings – IPOs. A clash of investment styles is common in marriages.

View More

In Times of Loss ...

May 17, 2019

Do you have a legacy plan? In terms of the future, make sure there is a plan in place for your own family members or survivors at the time of mortality so there is less weight and less difficulty for them. I thought this would be an appropriate time to talk about the missteps that could possibly occur during a time of loss and how we can become a victim of bad or rashly made decisions.

View More

Investing in a Financial Advisor

May 10, 2019

Client Fee Structure Options: Potential clients of a financial advisor fall into one of three categories as outlined below; commission as regulated by the financial industry, managed assets or a fixed fee. The category you might fall into depends on YOU! Your plans, goals, risk tolerance etc. My job, through our conversations, is to explain where you fit and why. #financialadvisor #investing #fees #FINRA

View More

Solitary Aging

April 26, 2019

I am an advisor of quite a few long-time clients who are approaching their twilight years. Positioning them for this next stage of life is a major concern of mine, especially the ones living alone. Elders living alone can face a risk of higher health issues and/or depression.

View More

No Free Lunch: STOCKS

April 22, 2019

Academics and finance professionals sometimes refer to the “risk-free rate of return” as a benchmark; in this context, the risk-free rate is the yield on cash assets, where you’re guaranteed stability of principal even as you pick up a slight (these days very slight) return.

View More

No Free Lunch: BONDS

April 11, 2019

Bonds; Interest-rate Risk, Credit Risk, Inflation, Reinvestment Risk Foreign Bonds; Currency Risk, Geopolitical Risk

View More

No Free Lunch or Risk-Free Retirement

April 8, 2019

Academics and finance professionals sometimes refer to the “risk-free rate of return” as a benchmark; in this context, the risk-free rate is the yield on cash assets, where you’re guaranteed stability of principal even as you pick up a slight (these days very slight) return.

View More

Tab on the Right

March 22, 2019

At Chestnut Investment Advisory we also offer a unique way of investing called $ymbil. $ymbil is a self-motivated online investment platform that assesses your investment risk profile and offers recommendations for a risk-appropriate managed approach. $ymbil is for all types of investors from novice investors opening their first account with small dollars to the experienced investor who wants a simple, quick, and easy way to invest capital.

View More

Our Style of Investing

March 8, 2019

We feel that the only difference between an aggressive investor and one who is risk averse is the relative weighting of equities, bonds, and cash in their portfolios. Aggressive investors would have more equities: typically 80% to 90% of their total portfolio’s value. Risk-averse investors would typically have as little as 10% of their portfolios in equities.

View More

In The Blink Of An Eye

March 4, 2019

I won’t bore you with the statistics because you wouldn’t believe me. All the numbers on aging are mind-numbing. For example, women live about five years longer than men and are far more likely to suffer from Alzheimer’s disease.

View More

Strategize With Bonds

February 21, 2019

As you probably know, asset allocation is a main topic of discussion on my radio show. Your investment funds need to be divided into risk, less risk, and low risk. The portion allotted to each segment depends on many factors. As you move through your lifetime from your first day at a full-time job until you go to your reward, bonds play a greater, and greater, and greater role in your portfolio.

View More

Why Do We Make Bad Decisions?

February 14, 2019

Life is one decision after another considering small, medium and large goals. It would appear that we could divide them in half - good decisions vs bad decisions. The benefit of a good decision is a general feeling of satisfaction. But perhaps I’m beating around the bush; and it is a big bush.

View More

How to Plan Your Financial Future

February 7, 2019

Our goal is to help our clients create a custom tailored investment portfolio designed to try and fulfill your many specific requirements and constraints. We firmly believe, regarding your money, that we take every effort to help you with your planning. Our approach is designed to help you articulate your true and realistic financial and investment objectives. Everything we recommend is based on listening to you.

View More

What I Have To Offer

January 30, 2019

Chestnut Investment Advisory was established in 1988. It is a financial advisement and wealth management firm. In 1993, after four years of study and testing, the Certified Financial Planner - CFP® license was granted to George Toth.

View More

Let's talk ETFs!

January 24, 2019

Let’s talk ETFs. First, what does ETF stand for – Exchange Traded Fund, and what does that define? An ETF will allow any financially sized investor to build a first class portfolio that will have superior transparency and lower expenses.

View More

Time for an Annual Portfolio Review!

January 17, 2019

For many investors, the thought of reviewing the performance of their portfolio over the past year is about as appealing as walking through seaweed; to swim you have to traverse the muck. Chestnut Investment Advisory offers a better way to enjoy the scene.

View More

About Retiring...

January 4, 2019

Retirement, it is the best of times and it is the worst of times…but there’s always the grandchildren. What does it mean to retire? I think there are 6 points to consider among the many other points.

View More

You Can't Take It With You

December 31, 2018

How would you like to work hard your entire life to achieve financial success, only to lose it by making uninformed estate planning mistakes? Those mistakes can result in your family losing over half of the assets you have accumulated. They can destroy much of what you worked for your entire life not to mention inflicting a great deal of heartache and pain on the people you love.

View More

Financial Planning; Get Started

December 12, 2018

I will explain the fundamental issues upon which our relationship is based, how an advisor is compensated for service, and list a partial explanation of the benefits for each category. We can help you meet your future goals, safely, securely, at your own comfort level.

View More

Pothole Season

December 5, 2018

If you are happy with the state of your financial highway, go no further, stop. If you have your finances and investments under control and well directed, roll on. On the other hand, financial and investment potholes will blow your tires. Consider these tips and avoid deep holes. On you financial and investment road ahead.

View More

Algorithm for Financial Planning

November 20, 2018

This article is an algorithm for Financial Planning. This, however, is NOT the six step financial planning process of policy development. Rather, it is a way to notch some trees as we move toward a market correction or disturbance, and get to a subsequent clearing …

View More

Which path to choose ... ?

November 7, 2018

I saw the writing on the wall and the floor, big business was not for me. Sloshing around in my mind was the fact that I had to make money, and fast. As a 32 year old the question of what I wanted to be when I grew up was large.

View More

Protecting Your Future

November 1, 2018

Growing up in the 50’s did not prepare me for the 21st century’s demands. In those days, “flying by the seat of your pants” was possible, if not a good idea. The times were tolerant and settled. (I am not talking about the social or cultural attitudes.) I mean, if you did not plan your financial life, you could scrape by.

View More

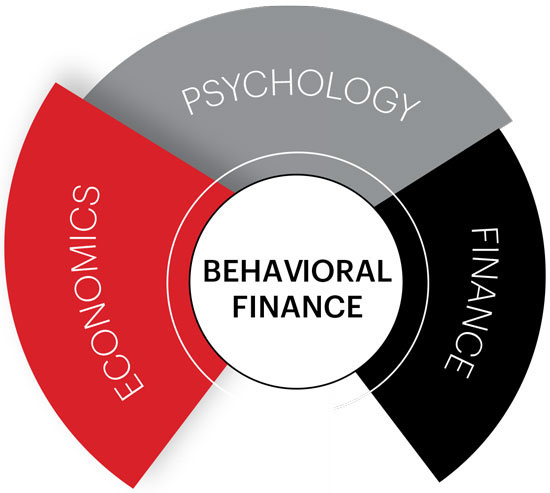

Behavioral Finance

October 25, 2018

Over the past decades, trusted advisors have looked for the best ways to inform, structure and build sound financial and investment strategies for their clientele. Contrary to popular belief, financial planning is not investment planning nor is it designed to accurately predict or handle the fluctuation in market trends; it is done to help formulate knowledgeable and well-formed financial strategies with the greatest chance for success over long periods of time.

View More

The Big Secret

October 18, 2018

I am letting The Big Secret out of the bag! There is no bigger secret than planning! People do not plan to fail, they fail to plan. The process of financial planning or investment policy development is a challenge. Most people plan in reverse: they plan after the fact. Bad. All planning should be done with the goal in mind.

View More

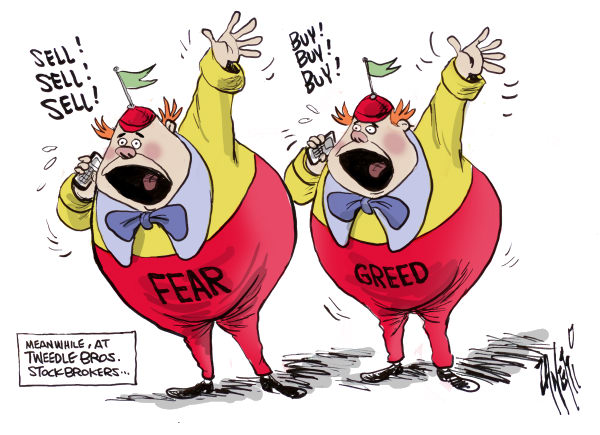

FEAR and GREED

October 10, 2018

Fear and Greed – these two emotions can wreak havoc on even the most well-intentioned investor. It’s been this way since – forever.

View More

How does a Financial Plan Start?

October 4, 2018

The process of Financial Planning is an art and a science. When it was developed over 60 years ago, it was the intersection of the private banking and investment industry. Along the way, risk management, goal setting and other analytical methodologies were added. And as such, the process has split into 2 usages: one Goal Based and the other Cash Flow Based. Cash Flow Based, or at Chestnut what we call Gap Analysis, is more complex, and a better way to achieve your objectives.

View More

Ethics

September 26, 2018

"Whoever is careless with the truth in small matters cannot be trusted with important matters." – Albert Einstein My industry is one of the most regulated when you compare it with others. I am regulated by my CFP Board of Standards, the Institute of Investment Management, FINRA, the PA Department of Banking and Securities, and the broker/dealer I operate through; all are overseeing my activities.

View More

EARLY RETIREMENT?

September 19, 2018

Early retirement may not be all it’s cracked up to be. How so you ask? It’s not the money here; it’s the gestalt of psychology for early retirement. Is the whole really worth the sum of its parts?

View More

Five Keys to Investing

September 11, 2018

There are many keys to investing. Here are five that have stood the test of time.

View More

Saving for College?

August 30, 2018

With today’s costs of a college education sharply rising, a 529 plan is a tax-advantaged savings plan that can help save for future college expenses. Introduced in 1996, 529 plans are sponsored by states, state agencies, or educational institutions and may vary slightly between states.

View More

Is Money the Root of all Evil?

July 25, 2018

The future is both full of peril and opportunity. Money has been created and destroyed at an unparalleled pace. Money is racing around in fiber optic cables, impulses powered by a nascent global economy. Like it or not, we are headed to that dock, with all the peril and opportunity money can buy.

View More

Humpty Dumpty Was Imprudent

July 18, 2018

Mr. Dumpty's imprudence is clear. The market is surely unsafe if you are just going to hang out; playing around; from there you could fall and never get back up.

View More

You Have Three Choices

July 12, 2018

I am not a big fan of Jeopardy! or reality TV. Reality is challenging enough for me, thank you. I do watch many movies, and I especially love classic movies. The old ones I can re-watch, rewind and re-watch, and so forth. There are so many to choose from that I will never run out of options. After all, having options is what makes this country best.

View More

Identifying & Dealing with Dementia

July 12, 2018

Ten ways to tell if an elder is losing it. Concerned about an elder? The Alzheimer's Association highlights ten early signs of dementia.

View More

Fifth Installment: The Fourth Foundation

June 27, 2018

The previous three foundations in this series were Risk Management, Cash Management, Variable Assets and now a description of Fixed Assets. As the title implies, a Fixed Asset has the quality of a “fixture”. It just sits there. The image is of a table or foundation for a house. Each corner has to be set on solid ground and supports the architecture, the walls, wires and well-being of the inhabitants. Otherwise, the table wobbles and you spill the milk.

View More

Fourth Installment: Third Foundation

June 19, 2018

This Foundation will take a little longer to finish because it is so important to capture the entirety of why, what and how to build your financial house. These Foundations are the simple cornerstones set on solid rock, not sand, upon which you may erect just about any financial or investment future.

View More

Third Installment: The Second Foundation

June 12, 2018

The Second Foundation is Cash Management. Under Cash Management fall all the income, expenses, inflow and outflow schedules, conscious or unconscious, and formalized into the dreaded BUDGET. A budget is a snapshot of where you are right now. It can include an additional column called projected budget composed in the beginning of the year, then accompanied by the actual money spent, earned or received

View More

2nd Installment: The First Foundation

June 5, 2018

Evaluating insurance coverage isn’t uppermost in the minds of most of you, and it won’t insure a long and happy life or marriage. But, the right insurance can go a long way toward shielding you against the kinds of financial calamities that can strain a budget and sometimes break a marriage. Here are several key insurance areas that I recommend all of you to review.

View More

FOUR MAINSTAYS OF INVESTMENT THINKING

May 29, 2018

First Installment of a Five Part Series: Over twenty years ago when I first got my start in the financial services, I was taught about Four Cornerstones of Money Management. They are Cash, Variable Assets, Fixed Assets and Risk Handling. I understood then that every client had to have something in each of them, or at least address them in their asset allocation.

View More

Trying to Avoid Losses During Market Swings?

May 17, 2018

Dollar-cost averaging involves investing a fixed amount on a regular basis, regardless of share prices and market conditions. Theoretically, when the share price falls, you would purchase more shares for the same fixed investment. This may provide a greater opportunity to benefit when the share prices rise and could result in a lower average cost per share over time.

View More

RISK TOLERANCE & DIVERSIFICATION

May 10, 2018

RISK TOLERANCE is the degree of variability in investment returns that an investor is willing to withstand. You should have a realistic understanding of your ability and willingness to stomach large swings in the value of your investments; if you take on too much risk, you might panic and sell at the wrong time.

View More

5 Cybersecurity Best Practices

April 26, 2018

Keep Your Financial Information Safe Online With an increasing amount of personal financial information available online, it is more important than ever consumers follow the right precautions to ensure the security of their private financial information. Below are five proactive cybersecurity best practices to help keep your information safe.

View More

Single-Payer Healthcare

April 19, 2018

A revival movement is sweeping the nation. Millions of souls have already been converted, thanks to a charismatic preacher and his passionate disciples.

View More

Moving Toward a No-Debt Lifestyle

April 12, 2018

Any financial process begins with necessary changes in financial behavior. The degree of change varies based on financial priorities, but, in the end, it's about adopting good habits and abandoning bad ones. Here are some ideas: start with nickels and dimes, attack the highest-rate debt first, refinance if you can, make debt-fighting a family lesson, set some post-debt money goals, go debit.

View More

Author Patrick Deneen "Why Liberalism Failed"

April 4, 2018Patrick J. Deneen is the David A. Potenziani Memorial Associate Professor of Political Science and Constitutional Studies at the University of Notre Dame. He has previously taught at Princeton University and Georgetown University.

View More

We Are a Two Toothpaste Family!

March 20, 2018

We Are a Two Toothpaste Family!Jensen and I have agreed to disagree about toothpaste – she has hers and I have mine. Except hers is out because it matches the bathroom, mine is hidden in the linen closet. No troubles.When we were newlyweds, we had separate bank accounts too. She didn’t want to do Wills, POA’s, an Advance Medical Directive, nor a Living Will. Of course, today, we have solved the larger issues, so the toothpaste is a lower priority.What about yo

View More