The previous three foundations in this series were Risk Management, Cash Management, Variable Assets and now a description of Fixed Assets. As the title implies, a Fixed Asset has the quality of a “fixture”. It just sits there. The image is of a table or foundation for a house. Each corner has to be set on solid ground and supports the architecture, the walls, wires and well-being of the inhabitants. Otherwise, the table wobbles and you spill the milk.

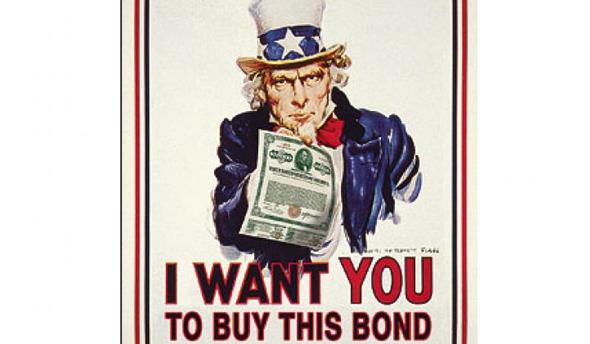

Since all things exist in a temporal environment, fixed assets are even more time sensitive than the variable assets foundation. Second, all fixed assets are a form of debt and are bound by a contract implicit or explicit, where there are guarantees relating to return of your principle and income. AND, this is so for Certificates of Deposit as well. Long-term CD’s in a rising interest rate environment are foolish.

Fixed assets are composed of a number of considerations. (Growth is not generally one of them.) These assets are used as sources of income and generally add stability to a portfolio. You can own them as individual assets or hold a mutual fund of fixed assets. Now, you can pick up a business section of any newspaper and see how many different types of bond funds there are. They all share common aspects: time value of money, macro/micro interest rate effects, and supply and demand for said bond. Rating agencies are in the mix to affect the price as well. Keep in mind the phrase, “time value of money” as it is critical with fixed assets; and all fixed assets are evaluated across a time horizon (TH). This is called the “yield curve”; the longer the TH, the greater the price and percentage effect on your money.

Fixed assets role in a portfolio, as I said, is to diversify the risk of variable assets with bonds unique nature. Each band will give a little different effect to a portfolio. Municipal Bonds are tax exempt and don’t correlate with variable assets much. Inter-bond correlation has to be considered, as diversification applies here as well. For larger dollar amounts, individual bonds make more sense than bond funds, if you know what you are doing. These are some of the issues to address in determining your Fixed Asset foundation.

As this is the last in the series, I want to wrap it up with a few more pointers …

Overemphasis on superficiality and the temporary is the delusion and nemesis of the world of finance. Benjamin Franklin

The assumption that it is feasible to outperform other investors in the active-aggressive kind of investment management that dominates today is ludicrous. Paraphrased, Charles Ellis

There is no system to beat the market. The future is never a simple replay of the past. Leon Levy

Most investors should utilize the three-pronged investment approach of market timing, stock selection and portfolio strategy … Nevertheless, this approach may be impractical for individuals who lack sufficient time and talent to devote to the investment decision-making process or whose portfolios are too small to permit adequate diversification; for most, active professional management is best. Paraphrased, Norman Fosback