A Target Date Fund (TDF) is a Mutual Fund that is structured to move a portfolio from higher risk and high growth in the early build-up years to more conservative choices at a specific date, generally the retirement date. This is done so as to protect the gains from the early growth years. Target Date Fund Managers do this by periodically rebalancing asset class weights back to the targeted allocation to – hopefully – optimize risk and return over a preset time frame. As an example, the target allocation for a 2030 Fund could be 25% stocks/65% bonds/10% cash while a 2065 Fund would be 100% in growth stocks.

According to Morningstar, in 2022 there was almost three trillion dollars invested in target date, or life-cycle, funds.

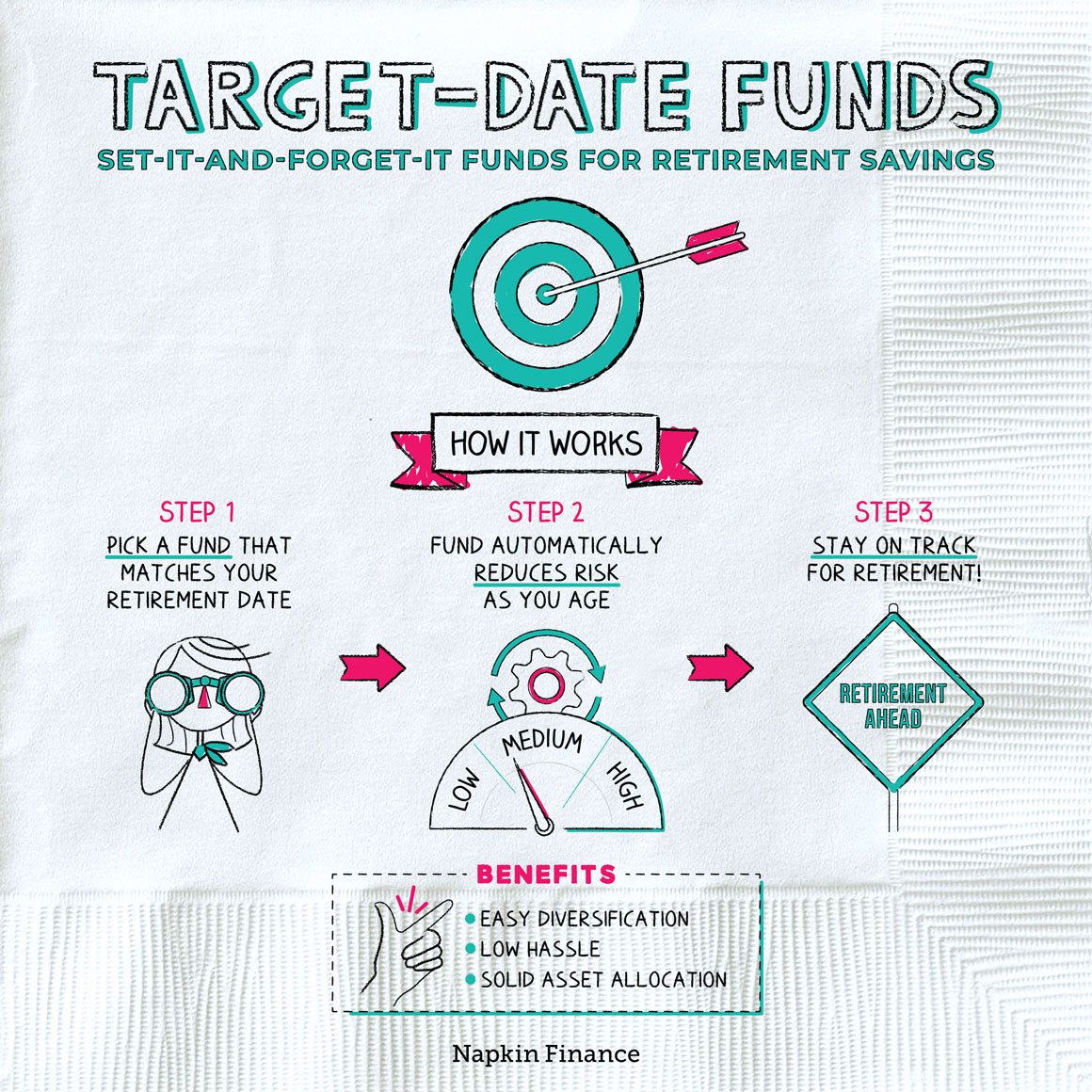

The appeal of these funds is that they allow the investor to ‘set it and forget it’ when it comes to their retirement fund. They remove asset allocation and investment selection from the investors’ hands. This is a great option for people who might not otherwise be able to afford retirement investment advice or who do not understand the basics of investing. Target Date Funds are for the retirement investor who does not want to be bothered with reviewing their portfolio every year (a.k.a. most people in company retirement plans).

Also, the investors don’t see the performance of the underlying holdings in the TDF so they are much less likely to be bothered by the market’s normal gyrations. Target Fund Investors count on their fund managers to know when to buy and sell. The Fund Manager operates what is called a ‘glide path’ easing the investor safely from an aggressive to conservative portfolio.

But, a TDF could go too conservative too quickly. The funds work with an algorithm to decide when to buy and sell. If the fund moves too soon from stocks to bonds, the investor could lose some potential for growth. With many of us living long after retirement, we may need that extra growth.

Or, a TDF could be too risky at the target date. Long-term bonds, once considered along with cash to be the safest investment may no longer be the safest. Given the actions around interest rates over the last year or so, rates are expected to increase still further, meaning that bond prices are more likely to decrease than increase.

Investing in a target date fund means that you believe that stocks will perform better than bonds over the long term. While this is most often true, it does not hold 100% of the time. As an example, due to the steep rises in interest rates in 2022, funds that appeared to be holding conservative investments actually experienced large declines as the rise in rates hurt both stock and bond prices.

Tyler Durden at ZeroHedge.com points out that the allocations between stocks and bonds in a TDF are not based on risk or reward but solely on the calendar. This increases the investment risk that the funds are designed to reduce. In addition, keeping only the long-term view means the investor may miss out on short-term opportunities on both stocks and bonds.

Not all target date funds are the same. One fund manager might be more/less aggressive in the early years than another with the same target date. The glide path can also look vastly different from one fund to another.

This set it and forget it mindset does not take into consideration changes in the investor’s other assets, personal situation or risk tolerance.

Holding a Target Date Fund outside of a retirement portfolio (401k, IRA) can cause unexpected tax consequences. Like other types of mutual funds, the target date funds generate taxable income every year which, by law, must be distributed. This is fine for low turnover funds but target date funds are by nature higher turnover because they have to keep to a pre-determined asset allocation. In years such as the last few, where there has been so much market volatility, these funds generated high capital gains distributions, taxable outside of 401Ks and IRAs.

Target Date Funds are not personalized to the investor. The allocations between stocks and bonds are based solely on the target date of the fund whereas a good financial advisor will create a plan that takes into account all of the investor’s other assets and their personal risk and return stance.

I can help guide you to an investment plan that is mindful of your personal considerations as well as your financial ones. If you are invested in a TDF, I can review how this fund fits into your total investment portfolio and make suggestions to better meet your goal of a happy, healthy and financially sound retirement.

Please feel free to call (215-836-4880) or email the office (ellend@regardingyourmoney.com) to set up an appointment to discuss any financial questions you may have. Or visit us at regardingyourmoney.com

Sources: Investopedia, Morningstar, Bankrate.com, ZeroHedge.com, FINRA.org, RHSFinancial.com, Seeking Alpha