What is Stagflation? Are we in a period of Stagflation right now?

The Investopedia definition:

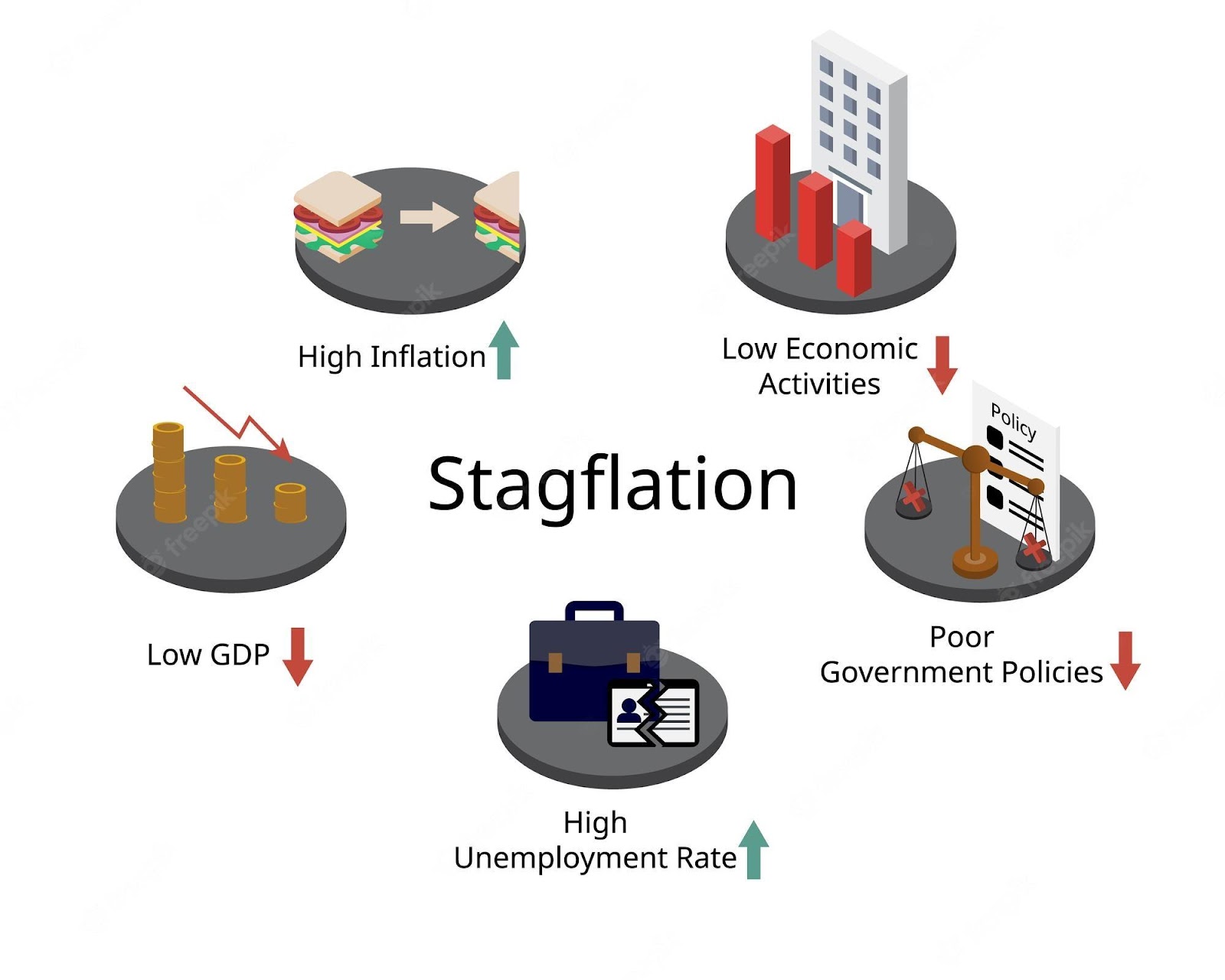

- Stagflation is the simultaneous appearance in an economy of slow growth, high unemployment, and rising prices.

- Once thought by economists to be impossible, stagflation has occurred repeatedly in the developed world since the 1970s.

- Policy solutions for slow growth tend to worsen inflation, and vice versa. That makes stagflation hard to fight.

What Causes Stagflation?

Economists continue to argue about the root causes of stagflation. One cause that can set the world economic stage for stagflation is a ‘supply shock’. This happened at the start of the COVID-19 pandemic when the production of nearly everything stopped due to the shortage of essential parts, e.g., semiconductors. This shock impacted all three factors that can cause stagflation: economic growth, employment and inflation.

Stagflation, according to the logic of economics, should not occur. Prices should not go up when there is low growth, high unemployment and people have less money to spend. Real world experience has shown that this is not always the case.

Are we in a period of Stagflation right now?

Maybe, maybe not. While the US economy still seems to be going strong, economists are seeing some slowing during the second quarter and beyond.

This is partly the result of the Federal Reserve’s interest rate increases. Interest rate increases normally cause a decline in business investment and reduced household spending. And, due to this expected slowdown in growth, the Congressional Budget Office is projecting that the US unemployment rate will rise to 5.1% by the end of 2023, up from 3.6% in the final quarter of 2022. The outlook globally is even less optimistic.

That being said, how best to invest in this period of (maybe) stagflation? Stagflation makes for increased uncertainty and volatility in the markets. For investors, stagflation typically means lower returns as economic growth slows.

Stagflation investing is a defensive approach to managing an investment portfolio to minimize the risks of rising prices and a shrinking economy.

Some strategies to consider:

- Diversify your portfolio: A diversified investment portfolio can help mitigate risks associated with stagflation. By spreading your investments across different asset classes, such as stocks, bonds, commodities, and real estate, you can potentially offset losses in one area with gains in another.

- Focus on defensive sectors: Certain sectors tend to perform relatively better during stagflation. Defensive sectors, such as consumer staples (food, beverages, household products) and healthcare, often fare well during economic downturns. These sectors provide essential products and services that people continue to demand even in difficult times.

- Stay away from growth stocks. When economic growth slows, growth companies may react by pulling back on expansion plans. Slower growth can negatively affect prices for those stocks and the associated returns from those investments.

- Consider inflation-protected assets: Stagflation is typically accompanied by high inflation. Investing in assets that offer protection against inflation can be beneficial. Treasury Inflation-Protected Securities (TIPS) are bonds issued by the U.S. government that adjust for inflation. These bonds can provide a hedge against rising prices as their value increases with inflation.

- Invest in commodities: Stagflation often leads to an increase in commodity prices. Investing in commodities, such as gold, silver, oil, or agricultural products, can be a way to benefit from rising prices. You can consider investing directly in these commodities or through exchange-traded funds (ETFs) or commodity futures contracts.

- Seek international diversification: Stagflation may affect different countries and regions differently. Consider diversifying your investments globally to take advantage of economic conditions that may be more favorable in other countries or regions. This can be achieved through international stock markets or global ETFs.

- Be cautious with fixed-income investments: Stagflation can erode the value of fixed-income investments, such as bonds, due to rising interest rates and inflation. If you invest in bonds, consider shorter-term bonds or inflation-protected bonds to help mitigate these risks.

- Consider real estate. Real estate investments tend to have a low correlation with stocks and people still need housing during an economic slowdown. Rental prices usually move with inflation and sometimes outpace it, even when the value of the dollar drops.

- Stay informed and adapt: Keep a close eye on economic indicators, such as inflation rates, GDP growth, and central bank policies. Stagflationary conditions can change over time, and it's important to adapt your investment strategy accordingly. Stay informed about market trends, economic news, and expert analysis to make informed investment decisions.

Know that stagflation is not likely to last forever. While our portfolios may take a hit in the near term, it’s possible to recover with a long-term investment strategy in place. As always, stay the course through the market swings.

I can help you to create a path through today’s economic and investment uncertainties. Please feel free to call (215-836-4880) or email the office (ellend@regardingyourmoney.com) to set up an appointment to discuss any financial questions you may have. Or visit us at regardingyourmoney.com

Sources: Investopedia, SmartAsset, Global Outlook